Transactions

-

200 Broomielaw, Glasgow

Asset Management Mandate

Müller International acquired the building for the client as a core plus asset opportunity. The Müller Asset Management team have been appointed to provide Asset and Property Management services.

Müller International has now been engaged by the family office to asset manage the property over the coming lease expiries and to advise on the upgrading offered by this phase in the property’s life-cycle.

Müller will reposition the building, lead the refurbishment project and relet the building as part of the overall asset strategy.

Müller’s Asset Management team have taken operational control of the building and put in place systems and procedures to improve the operation of the building and onboard an asset with numerous historic challenges.

Enquiries to: David Carlsson-Evans

Tel: +44 (0) 207 448 1160The instruction demonstrates:

- Integrated Investment and Asset Management services

- Clear Strategic planning and delivery

- Dynamic team appointments allowing Müller to secure best in class consultants to deliver business plan

-

Portman Square House, London

Asset Management - Lease Restructuring

Acting in their Asset Management role Müller has successfully re-structured a new 10 year lease at the well-known office building overlooking Portman Square in London’s West End, substantially increasing from 21,990 sq. ft./ 2,043 sq. m. up to 47,425 sq. ft. / 4,406 sq. m. Invesco’s occupancy in the property. This involved the surrender of a number of other leases in Portman Square House and a re-gear of the existing Invesco space.

As a result of this exercise carried out by the firm’s asset management department Portman Square House will have the two anchor tenants of Cushman & Wakefield and Invesco, as well as a number of retail occupiers in this prominent location just to the north of the Marks & Spencer flagship store on Oxford Street.

Through the restructuring, the lease buy-back and the surrender negotiations Müller was able to meet Invesco’s space requirement for a single London location. In doing so we secured new 10-year leases at the property on over 50% of the property and at open market rents, for the investors Colony North Star Realty Europe.

The asset management deal rationalises the number of leases and occupancies in the building and, importantly, improves the tenant profile in the property materially extending the unexpired lease terms for the investment. This improved income profile as well as its enhanced quality has resulted in, a key consideration, a significant increase in the capital value for the investors.

Enquiries to: David Carlsson – Evans

Tel: +44 (0) 207 448 1160 -

12 Golden Square, London

Asset Management Mandate

The Müller Asset Management team has recently been awarded the management brief for 12/12A Golden Square in London’s Soho area of the West End by Swiss pension fund association AFIAA.

The building was acquired in December 2017 from UBS and extends to some 27,000 sq. ft. /2,500 sq. m. over 7 floors above ground with one lower ground level. Dating from the early 1990’s the property was fully refurbished in 2015 to attract anchor tenant Diageo with four other occupiers.

Located at the south eastern corner of Golden Square the prime situation in the Soho district is well connected to the underground network at Piccadilly Circus, Oxford Circus and now the new Elizabeth Line (Crossrail).

The building has a “Very Good” Breeam rating. Golden Square is mentioned in Charles Dickens’ The Life and Adventures of Nicholas Nickleby.

Enquiries to: Ashley Bunkall

Tel: +44 (0) 207 448 1160 -

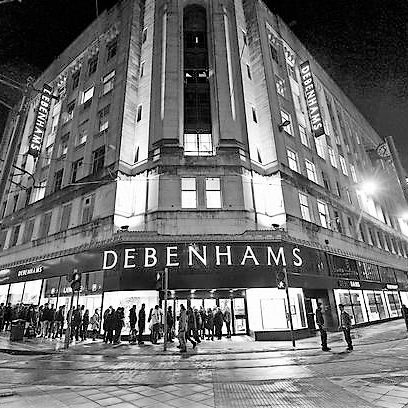

The Rylands Building, Manchester

Acquisition

The Müller investment team sourced and advised on the purchase by Munich based German family office AM alpha, of this Central Manchester landmark building.

Situated in the CBD and prime retail location at the corner of Market Street and High Street overlooking Piccadilly Gardens the building is let to the noted retail group Debenhams Plc. The Rylands Building extending over 10 floors for a total of 470,000 sq. ft./ 43,665 sq. m. , dates from the 1930’s. The property is Grade II listed and was designed by the renowned Manchester architect Harry S. Fairhurst after the Art Deco style.

“It is refreshing to see that foreign investors, in this case German, are interested in investing not only in London but also in one of the big 9 cities after all the scepticism that Brexit caused lately” said Peter Shapeero, Managing Director of Müller International.

The Manchester conurbation has an estimated population of some 2.8m people, being the second most densely populated area of Great Britain. The primary catchment area is about 1.65m people of which some 785,000 are considered the “shopping population” of the town.

Enquiries to: Peter Shapeero

Tel: +44 (0) 207 448 1160 -

Schomberg House, 80-82 Pall Mall, London

Asset Management Mandate

The Müller Asset Management team has recently been awarded the management brief for Schomberg House at 80-82 Pall Mall in London’s St. James district by Swiss pension fund association AFIAA.

The building was acquired in autumn 2017 from PGIM Real Estate and extends to some 37,000 sq. ft. / 3,500 sq. m. over 5 floors above ground, and one lower ground floor.

The building is let to fund managers Permira Advisers for another 15 years.

Located on the south side of Pall Mall at the western end, the building has a distinctive red brick façade with modern extensions on the rear (south) side. The property dates from 1688 when it was purchased by the Duke of Schomberg, William of Orange’s second in command, as a single residence. Other occupants have included the painter Thomas Gainsborough.

Enquiries to: Ashley Bunkall

Tel: +44 (0) 207 448 1160 -

200 Broomielaw, Glasgow

Acquisition

The Müller International investment team sourced and advised on the purchase by a German family office of this central Glasgow office building overlooking the River Clyde.

The modern building, which extends to some 80,000 sq. ft. over 9 floors with 31 additional car parking spaces at basement level, dates from 2004 and is fully let until early 2021 to Atkins and Chubb, each with a D&B 5A1 rating. The property is located within Glasgow’s IFSD (International Financial Services District), an area favoured by Scottish Enterprise to provide for and attract inward investment to the UK’s second city.

“It is interesting that whilst some of the more institutional investors, and overseas buyers from further afield, seem hypnotised by the on-going Brexit brouhaha in London that a German family office can still recognise a good opportunity. The opportunity presented a limited downside position and combined with the weakness of sterling and a healthy local market in Glasgow this creates a great prospect for our client to steal a march on their more cautious competitors” said Peter Shapeero director of Müller International’s investment team. “We have been pretty active over the last number of years in Glasgow so we are able to recognise a good opportunity quickly enough” continues Peter Shapeero.

The relatively short lease terms were identified by Müller as providing an attractive opportunity for asset managing both the income stream, given the attractive rental growth prospects within the building, as well as within the IFSD itself which has now come of age since the building was completed in 2004. In a market where tenant expectations and their staff’s anticipation of the working environment relentlessly increase Müller see this as an opportunity to upgrade the building both from an environmental standpoint and by considering its design profile.

Müller International has had a long association with Glasgow since it has proven a popular investment destination with a number of German investors over the last 20 plus years.

Enquiries to: Peter Shapeero

Tel: +44 (0) 207 448 1160 -

Condor House, London

Asset Management Mandate

Our Asset Management team was instructed by the Investor to manage the property.

The property, acquired in 2015, originally formed part of a £1.1 billion portfolio comprising of 11 buildings throughout Europe. Following an intense period of Asset Management the property was sold in mid-2019.

Condor House is located immediately opposite St Paul’s Cathedral with circa 120,000 sq. ft. of office accommodation offering unrivalled views of the cathedral’s entrance and west elevation. The building is the UK headquarters for both Morgan Lewis & Bockius, Moelis as well as the London office of Shepherd and Wedderburn. Nine restaurants complete the ground floor accommodation including Café Rouge, Pizza Express, GBK and Yo! Sushi.

Enquiries to: David Carlsson – Evans

Tel: +44 (0) 207 448 1160 -

Central Manchester

Asset Management Mandates

Following a recent review of the asset performance, it has been decided to refurbish, reposition and relet the properties.

Müller has taken the lead role in the repositioning strategy, appointing design teams, contracts and leasing teams to deliver Spring Garden’s project.

Our Asset Management team was originally appointed to asset and property manage two multi-let office buildings located in Manchester’s Central Business District – 19 Spring Gardens and 44 Peter Street.

19 Spring Gardens comprises a total of 36,000 sq. ft. (3,344 sq. m.) of mainly office accommodation along with two retail units, occupied by several businesses including Lockton Insurance, Clarke Willmott and The Re-Think Group.

44 Peter Street is a nine storey 25,000 sq. ft. office building let to tenants including Kennedy Solicitors, Griffith & Armour, Buck Consultants and Hurd Rolland architects.

Both properties present significant asset management potential through active lease management, and are added to a substantial portfolio of UK office properties managed by our team.

Enquiries to: David Carlsson-Evans

Tel: +44 (0) 207 448 1160These asset management mandates demonstrate:

- The type of asset management services we provide for international investors invested in UK commercial property.

- How, as investor's representative in the UK, we are able to protect our client's investments and add value through active asset management.

-

Portman Square House, London

Asset Management Mandate

Our Asset Management team was instructed by the Investor to manage the property.

The property, acquired in 2015, originally formed part of a £1.1 billion portfolio comprising of 11 buildings throughout Europe. Following an intense period of Asset Management the property was sold in mid-2019.

Located in a prominent position on the corner of one of London’s most famous squares, Portman Square House offers over 100,000 sq. ft. of grade A office accommodation with retail space on the ground floor. The building provides the head office location to both Cushman & Wakefield and Invesco UK as well as having Nationwide in the location of the original Portman Building Society.

Enquiries to: David Carlsson – Evans

Tel: +44 (0) 207 448 1160 -

3 Hardman Square, Manchester

Asset Management

3 Hardman Square is a prominent, high quality Foster & Partners office building at the acclaimed Spinningfields development, comprised of 180,000 sq.ft. (16,722 sq.m.) Of Grade A office space.

The property was left vacant due to the tenants, UK Law firm, Halliwells going into administration. The Müller Asset Management Team coordinated the complete refurbishment and reletting of the office space to a variety of good quality tenants so recreating the investment value. Müller representatives also served on the Liquidation Committee established by BDO to reclaim as much money as possible to mitigate their client’s loss.

The involvement of Müller International’s Asset Management team was critical to the transformation of the building into a leading, vibrant multi-tenanted office.

Enquiries to: Geoffrey Marriott

Tel: +44 (0) 207 448 1160- How we work for international investors invested in UK commercial property.

- Our unique Müller Edge approach to asset management, allying our experience and expertise with use of specialists for specific assignments, to best address our client's needs.

- As the investor's representative in the UK we are able to protect our client's investments and actively manage their risks.

-

Gresham St Paul’s, London

Development & Investment Consultancy

Advised on the process of sourcing an appropriate partner for AFIAA in a development management capacity, originally via equity partnership / injection. The partner needed to offer a proven track record in London, ability to refurbish and extend the existing building when Schroders vacate, whilst catering for a flexible occupational offer once remodelled.

Stanhope PLC were selected as the preferred development manager and are currently undertaking a design process to enable increased massing and efficiencies within the building. This will enable a rebranding of the building and successful re-letting campaign. Müller International continue to asset and property manage the building.

Enquiries to: Peter Shapeero

Tel: +44 (0) 207 448 1160 -

Holborn Tower, London

Asset Management Mandate

Our Asset Management department originally appointed to property manage the prominent tower building was later appointed asset managers to reposition the property.

This is a substantial mixed-use building arranged over 11 floors, with retail accommodation on the ground floor and office space on the upper floors. The building presented significant short- and medium-term asset management opportunities to add value through refurbishment, lease restructuring and reletting at increased rental value.

Müller negotiated vacant possession of the office space and undertook complete refurbishment.

Holborn Tower is located in the rapidly improving and diversifying Midtown area, which is finding favour with a range of occupiers and property investors. The area’s emergence is underpinned by a buoyant London economy and the anticipated benefits flowing from the new east-west London Crossrail link.

The strategy has delivered new occupiers at improved rental levels delivering the asset strategy agreed with out clients.

Enquiries to: Ashley Bunkall

Tel: +44 (0) 207 448 1160 -

151 Buckingham Palace Road, London

Disposal

Having acquired the building for a major Malaysian fund Müller International negotiated the disposal terms of this 193, 693 sq. ft. office and retail property developed over Victoria Station in the Victoria district of the West End.

Purchased two years previously for £207 million the firm negotiated a disposal price of £255 million for the sellers, a 23% increase over the 2 year period.

The successful disposal at a starkly increased value demonstrates the firm’s ability to monitor market conditions in the improving and transforming Victoria District. It further shows Müller’s ability to advise clients of opportunistic profits, stemming also from fundamental strategic advice to the client right from the purchase phase, in order to set up a ‘future of optionalities’.

Enquiries to: Peter Shapeero

Tel: +44 (0) 207 448 1160 -

10 Aldersgate Street, London

Asset Management – Major Refurbishment

10 Aldersgate is a 40,000 sq.ft. (3,716 sq.m.) office building, located between the Museum of London and St Paul’s Cathedral, where a German property fund Hansainvest hold a long leasehold interest.

Following the expiry of the single lease, Müller International negotiated the letting of two floors to existing sub-tenants. Our asset management team assembled and led a project to oversee the refurbishment of the building to grade A specification, together with the replacement of major items of mechanical and electrical plant, within budget and on schedule.

Enquiries to: Geoffrey Marriott or Ashley Bunkall

Tel: +44 (0) 207 448 1160 -

Gresham St Paul’s, London

Asset Management – Tenant retention

Our Asset Management department successfully negotiated the restructuring of the occupational lease with renowned fund manager Schroders Investment Management of its 160,000 sq. ft. (14,864 sq. m.) headquarters at Gresham St Paul’s in The City of London. The lease had been due to expire in 2015.

Müller International were able to present terms to Schroders convincing them to remain in their existing highly-visible headquarters building, owned by Swiss pension fund AFIAA, rather than a planned relocation to a newly-developed building.

The successful retention of a prestigious tenant, and the achievement of improved terms for the client, illustrate our asset managers’ ability to lessen investors’ exposure to risk and improve asset values for our clients.

Enquiries to: Geoffrey Marriott or Ashley Bunkall

Tel: +44 (0) 207 448 1160